Buy Gold and Silver Bars Online in the UK | Trusted Bullion Dealer with Competitive Prices

Buy Silver & Gold Bars in the UK from the Number 1 Trusted Bullion Dealer.

POPULAR BARS

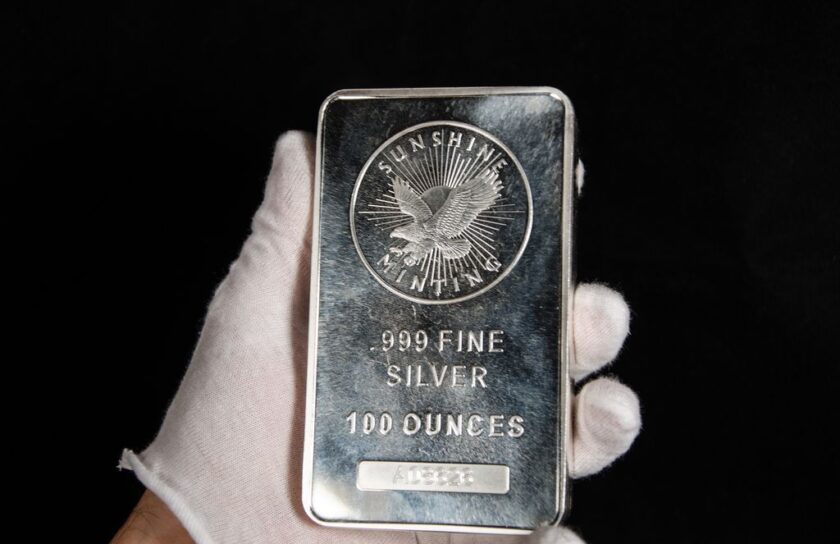

Gold Bullion Dealers 1 Kilo Silver Bar

From £791.28 Ex VatGold Bullion Dealers 100 Gram Silver Bar

From £99.48 Ex VatUmicore 50 Gram Gold Bar

From £3,173.28Metalor 1 oz Gold Bar

From £1,926.55NEW PRODUCTS

Plain 500 Gram Silver Bar

From £411.42 Ex VatPlain 250 Gram Silver Bar

From £219.46 Ex VatPlain 100 Gram Silver Bar

From £99.57 Ex VatPlain 50 Gram Silver Bar

From £50.88 Ex VatPlain 1 Kilo Silver Bar

From £791.28 Ex VatSILVER BARS

Gold Bullion Dealers 1 Kilo Silver Bar

From £791.28 Ex VatGold Bullion Dealers 100 Gram Silver Bar

From £99.48 Ex VatGold Bullion Dealers 250 Gram Silver Bar

From £219.27 Ex VatGold Bullion Dealers 50 Gram Silver Bar

From £50.88 Ex VatGold Bullion Dealers 500 Gram Silver Bar

From £411.42 Ex VatMetalor 1 Kilo Silver Bar

From £801.57 Ex VatMetalor 100 Gram Silver Bar

From £105.91 Ex VatMetalor 250g Silver Bar

Metalor 500 Gram Silver Bar

From £415.45 Ex VatPlain 1 Kilo Silver Bar

From £791.28 Ex VatPlain 100 Gram Silver Bar

From £99.57 Ex VatPlain 250 Gram Silver Bar

From £219.46 Ex VatPlain 50 Gram Silver Bar

From £50.88 Ex VatPlain 500 Gram Silver Bar

From £411.42 Ex VatUmicore 1 Kilo Silver Bar

From £791.02 Ex VatUmicore 100 Gram Silver Bar

From £101.28 Ex VatUmicore 250 Gram Silver Bullion Bar

From £217.40 Ex VatGOLD BARS

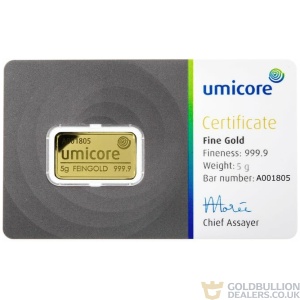

2.5 Gram Umicore Gold Bar

From £176.16Metalor 1 Kilo Gold Bar

From £60,868.61Metalor 1 oz Gold Bar

From £1,926.55Metalor 10 Gram Gold Bar

From £650.23Metalor 100 Gram Gold Bar

From £6,175.61Metalor 20 Gram Gold Bar

From £1,261.32Metalor 250 Gram Gold Bar

From £15,334.82Metalor 5 Gram Gold Bar

From £333.37Metalor 50 Gram Gold Bar

From £3,115.07Metalor 500 Gram Gold Bar

From £30,603.06Umicore 1 Kilo Gold Bar

From £61,677.75Umicore 1 Ounce Gold Bar

From £1,948.04Umicore 10 Gram Gold Bar

From £670.12Umicore 100 Gram Gold Bar

From £6,464.61Umicore 20 Gram Gold Bar

From £1,329.64Umicore 250 Gram Gold Bullion Bar

From £15,749.71Umicore 5 Gram Gold Bar

From £339.53Umicore 50 Gram Gold Bar

From £3,173.28Umicore 500 Gram Gold Bar

From £30,897.15Your Trusted Bullion Company

As a leading bullion company, Gold Bullion Dealers is committed to delivering excellence in every transaction. Whether you’re looking to buy silver for immediate gains or invest in gold for long-term stability, we’re here to guide you every step of the way.

Mastering Purity and Precision: The Art of Gold and Silver Bullion Creation at GoldBullionDealers.co.uk

Welcome to GoldBullionDealers.co.uk, the UK’s leading destination for premium Gold and Silver Bullion Bars and Coins. Our commitment to authenticity and quality shines through every meticulously crafted coin and bar we offer. Explore our Metalor Gold Bars, ranging from 100 grams to 1 kilo, and our Umicore Silver Bars, perfect for investors and collectors alike.

Dive into the world of bullion with our Blog, where we provide insights and tips for both novice and seasoned investors. Our authentication process, showcased in our YouTube video, underscores our commitment to combating counterfeit products and ensures the highest standards of purity.

Whether you’re interested in expanding your collection with our 1-ounce Britannia Silver Coins or making a significant investment in a Metalor 1 Kilo Gold Bar, we’re here to guide you through the process. Our Comprehensive Guide to Gold Bullion Investment and Silver Bullion Investment Tips offer valuable information to help you make informed decisions.

Join the ranks of savvy UK investors who trust GoldBullionDealers.co.uk for their gold and silver needs. From our base in Birmingham’s Jewelry Quarter, we offer competitive prices, unparalleled quality, and expert guidance on every purchase. See why we are the top choice for buying and selling gold and silver in the UK!

We pride ourselves on transparency and authenticity, fundamental values in the precious metals market. Our commitment extends beyond just offering high-quality silver and gold products; we provide a window into our meticulous crafting process. Our YouTube video, boasting over 230,000 views, is a testament to our openness, detailing the precision and care in crafting our 100 Gram Gold Bars.

Delve into the heart of our operation with our informative video, which showcases the meticulous crafting of our bullion. From the initial molding to the final detailing, each Gold Bar and Silver Bar is created with unmatched precision and care. This dedication to quality ensures that when you invest in our gold and silver bullion, you’re receiving a product worthy of your trust and investment.

Join us at GoldBullionDealers.co.uk, where we combine traditional craftsmanship with modern innovation to deliver the finest gold and silver bullion in the UK. Explore our range of products today.

BRIEF OF THE COMPANY

Located in the heart of Birmingham’s Jewelery Quarter just 40 yards from the famous Clock Island, our Gold Bullion Company is the first choice for bullion seekers We are the best company to buy and sell gold quality gold products for over 25 years.Our online platform www.goldbulliondealers.co.uk is the best website to buy gold and silver. As an approved dealer for Metalor and Umicore products, we are a trusted gold dealer with a long-established reputation in the UK.

Our competitive prices make us the best online silver dealer and bullion dealer for those looking to invest in precious metals. We constantly monitor our competitors’ margins to ensure that our prices are the best, whether you’re buying a half sovereign or a one-kilo pure gold bar. We encourage our customers to visit our office for complete peace of mind, but all price locking must be done via our website. For larger deals, we follow up with a phone call to confirm and lock in the deal.

Our reputation for buying scrap gold from jewellery shops up and down the UK has made us a well-known name in the industry. We exhibit at all the major jewellery shows, including London’s IJL and Birmingham Spring Fair, for the past eight years.

If you have any questions about purchasing our products, please don’t hesitate to call us. We will be happy to talk you through your first online order and show you why we are the best choice for buying gold and silver in the UK.

POPULAR BRANDS

WHY BUY GOLD?

Experience the Excellence of Precious Metals with Gold Bullion Dealers, the leading Bullion Specialist in the UK. Specializing in a range of quality gold and silver products, we cater to both new and experienced investors. Our user-friendly website offers everything from coins to substantial investment bars, providing a seamless shopping experience.

Investing in gold is a wise choice, offering a hedge against inflation, acting as a safe haven in economic uncertainty, aiding in portfolio diversification, and serving as a tangible, globally recognized, and highly liquid asset. As a gold and silver retailer, we source our metals exclusively from trusted mints and foundries, ensuring authenticity and superior quality.

At Gold Bullion Dealers, we extend beyond sales to exceptional customer service. Our expert team is ready to assist you through your metal purchase and sale journey, helping you make informed, beneficial investment decisions.

Embark on your venture into the world of precious metals investment with Gold Bullion Dealers – your expert partner for buying and selling gold and silver in the United Kingdom.

GoldBullionDealers Financial Insights: Navigating the Gold & Silver Landscape

Dive into the latest financial news that shapes the gold and silver markets. From global economic trends to expert-backed gold and silver investing tips, discover why these precious metals remain timeless investments in an ever-changing financial world. Your guide to informed bullion investments starts here.

Understanding the Value of a 1 oz Gold Bar Investment

Your Guide to Purchasing a 1oz Gold Bar in the UK

How to Maximise Profits When Selling Silver Bars

Current Pricing for 1 oz Gold Bars in the UK Market

Where to Find the Most Affordable 1 oz Gold Bars

Investing in Precious Metals: The Worth of 1 Ounce Gold Bullion

How to Successfully Sell Your Silver Bars: Tips and Strategies

Current Market Value: 1 oz Gold Bar Price in the UK

Secure Your Wealth: Where to Buy a 1oz Gold Bar

Silver’s Soar: Navigating the Peak at £0.73 per Gram on the UK Market

Understanding the 1 oz Gold Bar: An Investor’s Guide

Gold Investment: The Trend That’s Shaping the Bullion Market

Current Spot

| Gold | £60.13 |

| Silver | £0.71 |

Request a FREE Mailing Pack

Shop for

Gold Bars

Current Scrap Prices

Current Gold Prices

- 9ct Scrap Gold – £22.12 per gram

- 14ct Scrap Gold – £34.41 per gram

- 15ct Scrap Gold – £36.87 per gram

- 18ct Scrap Gold – £44.24 per gram

- 21ct Scrap Gold – £51.62 per gram

- 22ct Scrap Gold – £54.04 per gram

- 24ct Scrap Gold – £58.99 per gram

Current Silver Prices

- Silver .999 – £0.64 per gram

- Silver .925 – £0.59 per gram

- Silver .900 – £0.58 per gram

- Silver .800 – £0.51 per gram

- Silver .500 – £0.32 per gram

- Silver 1 Oz – £19.87 per ounce

OUR PRODUCTS

Metalor 250g Silver Bar

Metalor 500 Gram Silver Bar

From £415.45 Ex VatUmicore 5 Gram Gold Bar

From £339.53Umicore 1 Ounce Gold Bar

From £1,948.04Metalor 5 Gram Gold Bar

From £333.372.5 Gram Umicore Gold Bar

From £176.16Gold Bullion Dealers 1 Kilo Silver Bar

From £791.28 Ex VatPlain 500 Gram Silver Bar

From £411.42 Ex VatPlain 250 Gram Silver Bar

From £219.46 Ex VatPlain 100 Gram Silver Bar

From £99.57 Ex VatWHY NOT INVEST IN?

Umicore 5 Gram Gold Bar

From £339.53Gold Bullion Dealers 50 Gram Silver Bar

From £50.88 Ex VatMetalor 5 Gram Gold Bar

From £333.37Metalor 500 Gram Silver Bar

From £415.45 Ex VatItems We Purchase

Are you considering parting with your precious metal items? You're in the right place, as we offer to purchase gold, silver scraps at leading market rates. Whether you prefer to transact online or visit us in person, our services are designed for your ease, allowing you to exchange your gold accessories, coins, or miscellaneous pieces for cash promptly.

Categories of Valuables We Acquire

- A variety of precious metals, such as gold, silver

- Unwanted broken jewelry

- Gold items, both hallmarked and non-hallmarked

- Gold sovereign coins

- All kinds of gold & silver ingots

- Gold of various purities, including but not limited to 8ct to 24ct, all hallmarked

- British silver coins minted before 1947 and 1920

- Medals and medallions crafted from gold and silver

- Hallmarked dental gold

- Gold timepieces, including wristwatches and pocket watches

- Individual loose diamonds

With a solid foundation of knowledge in the precious metals market, our seasoned professionals are adept at meticulously assessing each piece we receive. The process of selling gold and other precious metals is now straightforward and hassle-free – reach out to us for an estimate and transform your valuables into liquidity at once!

BRIEF OF THE COMPANY

Located in the heart of Birmingham’s Jewelery Quarter just 40 yards from the famous Clock Island, our Gold Bullion Company is the first choice for bullion seekers We are the best company to buy and sell gold quality gold products for over 25 years.Our online platform www.goldbulliondealers.co.uk is the best website to buy gold and silver. As an approved dealer for Metalor and Umicore products, we are a trusted gold dealer with a long-established reputation in the UK.

Our competitive prices make us the best online silver dealer and bullion dealer for those looking to invest in precious metals. We constantly monitor our competitors’ margins to ensure that our prices are the best, whether you’re buying a half sovereign or a one-kilo pure gold bar. We encourage our customers to visit our office for complete peace of mind, but all price locking must be done via our website. For larger deals, we follow up with a phone call to confirm and lock in the deal.

Our reputation for buying scrap gold from jewellery shops up and down the UK has made us a well-known name in the industry. We exhibit at all the major jewellery shows, including London’s IJL and Birmingham Spring Fair, for the past eight years.

If you have any questions about purchasing our products, please don’t hesitate to call us. We will be happy to talk you through your first online order and show you why we are the best choice for buying gold and silver in the UK.